How to Avoid Risk Blind Spots and Enable Innovation

Turn risk from a barrier to innovation into a tool for taking action. Get started today with our risk assessment tool.

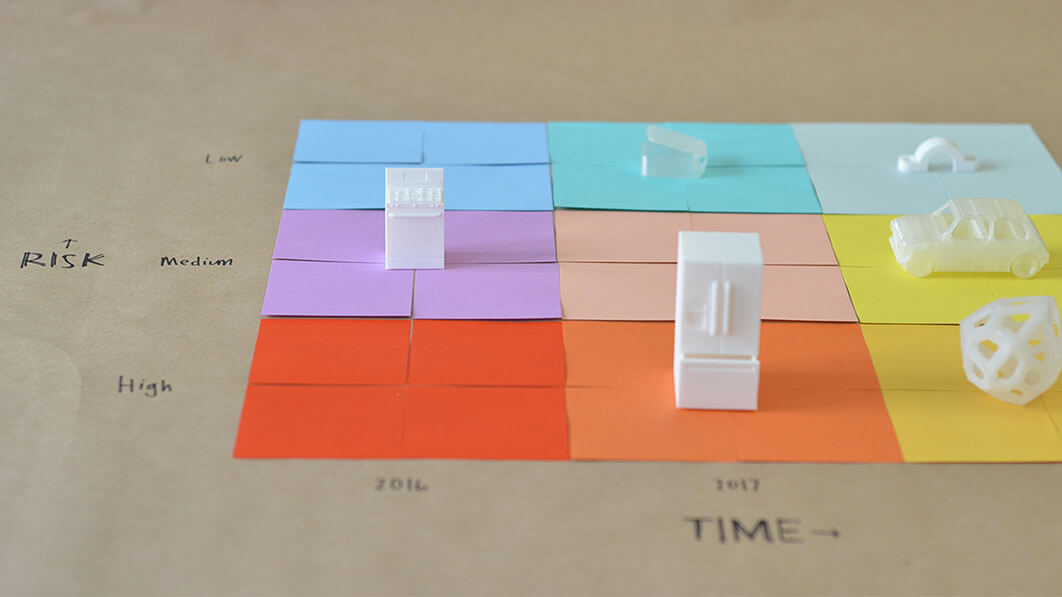

May 4, 2016

“We’re a risk averse culture.”

Sound familiar? More and more we hear “risk aversion” as the explanation for organizations failing to take action on something new.

Pursuing innovation is challenging for lots of reasons. If it is managed as a typical project, you’re asked to prove its ROI, plan every detail before moving forward, build conviction across multiple groups and prioritize resources…the list goes on.

In practice, these barriers reinforce the status quo. They discourage doing something new.

After a few rounds through the innovation gauntlet it’s easy to assume that your organization and its leaders are simply conservative and cautious. You characterize the hesitation to pursue something new as a symptom of risk avoidance.

The myth of the ‘risk averse’ culture

"For most organizations, doing anything feels riskier than studying and analyzing an opportunity. But do you really avoid risk by staying the course?

The short answer is ‘no’! There can be just as much risk in not changing as there is in trying something new. Consider the many companies like Blockbuster, Nokia, Kodak who couldn’t bring themselves to act differently in changing times.

So there is the risk that you recognize and the risk you don’t.

People are naturally better at recognizing specific risks and not others. These are ‘risk blindspots.’ Risk blindspots lead you to believe that inaction is safer than action. While you think you’re taking the safe route, you’re not accurately recognizing risk and opportunities."

Risk Blind Spots in innovation

"We facilitated a work session with a client to help them determine how “flaky” a new breakfast product should be. They understood that they had done some prior research. But after the daylong session dissecting and ranking all things “flaky,” we realized they’d been thinking about this for a while.

They had spent over two years quantitatively and qualitatively testing “flaky” as a concept!

The research gave them enough positive feedback to keep working. But it did not help build the conviction to launch a product. The fear of not getting it right and sustaining a loss prevented them from taking action.

While the team was focused on analyzing flakiness to make sure it was right, they weren’t diving deep on important issues like understanding market shifts and developing future innovation.

The shorter-term tasks felt most important to the project team and stakeholders. Exploring adjacent market opportunities and developing longer term products seemed less certain and more risky."

Misjudging risk

"Looking at the behavior of self-described ‘risk-averse’ companies, we see how these blindspots play out. The potential immediate losses of making a wrong choice loom large in our brains, while the upside–the payoff that may come down the road–is a hazy dream.

Doing something feels like a risk; continuing to analyze a decision feels safe.

But if you are honest with yourself, you know not doing something can be equally dangerous.

Not doing something means a competitor gains first mover advantage, or an industry shift sends a company into a long term decline. In the previous example, not moving forward tied up time, people and money that wasn’t used for growth.

Two risk blindspots lead you to mischaracterize and misvalue certain types of risk. These blind spots lead you to take on far more risk than you realize."

1. You avoid loss more than you seek gains

You overvalue the impact of loss relative to gains. In everyday terms, losing $100 feels twice as bad as winning $100 feels good.1

When you are deciding whether to invest in developing a new service, the budget or costs needed for development will feel more real than the return on the investment that has some uncertainty to it. You know this blind spot is at work when it feels there is nothing you can say to get approval for the effort.

2. You value the near term more than the long term

"You overvalue what happens to you now over what happens later. For example, you will likely prefer a gift of $100 now versus $110 next week.2

If you are choosing between launching a line extension that can be in the market this quarter versus a potentially more impactful item next year, you will likely pick the product and more immediate impact for next quarter."

How to better assess risks and avoid your blind spots

Getting honest with yourself about how to assess risk equips you to make better decisions. And it helps you be a better champion for innovation. You can highlight natural biases, as well as paint a fuller picture of the opportunity.

You can turn risk from an excuse into a tool.

To assess risk more objectively in your organization, start with this approach:

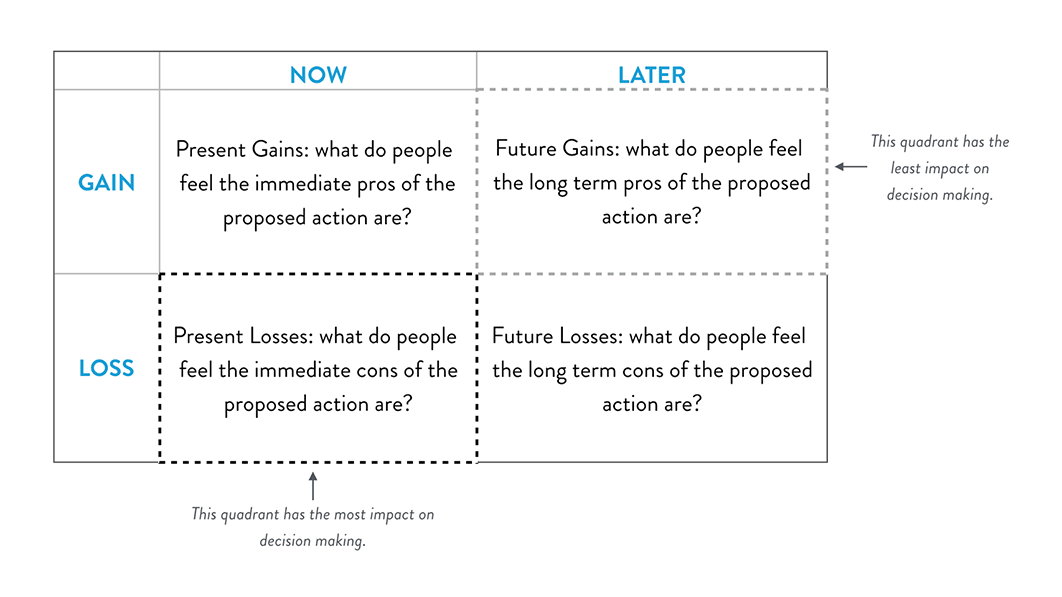

- Describe the potential outcomes of doing and NOT doing something.

- Surface natural biases by outlining those outcomes across 2 axis; now-later and loss-gain (see diagram)

- Fill in gaps to make a more complete risk and opportunity picture

Download the risk assessment worksheet

Download the risk assessment worksheet to assess your own ‘risk blindspots’ and decision making.

Sources:

1For more on loss versus gain, check out Prospect Theory, Tversky and Kahneman.

2For more on now versus later, check out Hyperbolic Discounting, Liabson

About Ann Hintzman